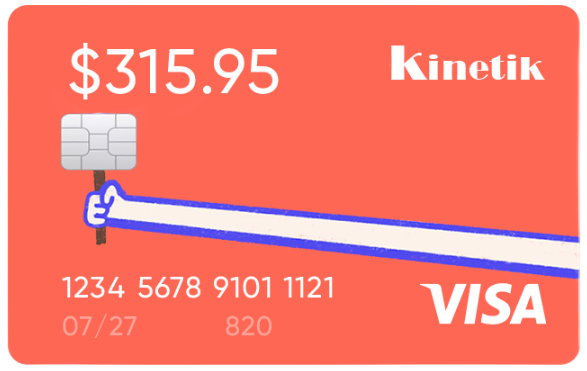

Our platform provides instant issuance of virtual prepaid cards Kinetik

Designed specifically to help you pay for various international services. Whether it's paying for apps, subscriptions, flights, hotels, or education fees abroad, our American virtual prepaid cards offer a seamless solution for all your global transactions. With Kinetik virtual prepaid cards, you can shop globally and handle your international payments.

We offer virtual prepaid cards:

- Instant issuance of Kinetik virtual prepaid cards for payment of international subscriptions, bills, and online services.

- Support for payments across the U.S., Europe, and other global regions, ensuring smooth transactions for travel bookings, e-commerce, and educational fees abroad.

Use Virtual prepaid cards Kinetik to:

- Pay for international subscriptions: Easily manage your accounts on platforms like Netflix, Spotify, Apple Music, OnlyFans, Patreon, JetBrains, and more.

- Book flights and hotels globally: Securely pay for your travels with virtual cards, enabling seamless booking experiences on international platforms.

- Pay for international education: Make payments for tuition fees or online courses with ease.

- Shop in U.S. and European stores: Whether it’s online shopping or retail, our cards enable you to make purchases in stores that require U.S. billing addresses.

Why Choose Virtual prepaid cards Kinetik?

- Global Accessibility: Accepted across most online platforms, are ideal for international shopping, subscription payments, and service bills.

- Quick Setup: Cards are issued instantly, allowing you to start using them right away.

- Flexible Payments: Top-up options available in USD, with a card balance valid for one year, ensuring no hassle in managing your payments.

How to Get Started:

- Choose your card: We offer card denominations ranging from $10 to $1000.

- Make a payment: Pay in usdt through our platform, and receive your virtual card details instantly.

- Start using your card: With the card number, CVV, and expiration date, you can begin making payments for international services and online shopping immediately.

Why Work with Us?

Support for international payments: We provide solutions for individuals and businesses facing payment restrictions, helping you pay for global services like PayPal, JetBrains, ChatGPT, Apple Music, TradingView, and more.

- PayPal Services: We assist with PayPal invoice payments, international purchases.

- Corporate Subscriptions: We handle payment for corporate subscriptions and software, including Google Workspace, Zoom, and other platforms.

- Instant issuance of Virtual prepaid cards Kinetik, designed specifically to help you pay for various international services.

Virtual prepaid card

A virtual prepaid card is a digital version of a prepaid card, similar to a physical debit or credit card, but it exists solely in digital form. It has a unique 16-digit card number, expiration date, and CVV code, just like a regular credit card, but you won’t receive a physical card. Here’s a breakdown of how they work and what they’re used for:

Key Features of Virtual Prepaid Cards

Preloaded Funds: Virtual prepaid cards are loaded with a specific amount of money in advance. You can’t spend more than the balance on the card, which makes them useful for budgeting and controlled spending.

Digital Use Only: Since they don’t have a physical card, they’re designed to be used for online or over-the-phone purchases rather than in-store shopping.

Enhanced Security: They offer extra security for online transactions. Since they are not physically present, there’s less risk of theft or loss, and they’re often used for single transactions or specific purposes. This limits the potential for fraud, as you’re not linking a primary bank account or credit line to the transaction.

Anonymity & Privacy: Some virtual prepaid cards provide a certain level of anonymity, as they may not require as much personal information as traditional bank-issued cards, making them appealing for one-time or private online purchases.

How They’re Used

Virtual prepaid cards can be used for a wide variety of online transactions, including:

- Online Shopping: Use them like a regular credit card to shop at online retailers.

- Subscription Services: Pay for recurring subscriptions to streaming services, software, or other online platforms.

- International Payments: In regions where local payment methods may not work on international websites, a virtual prepaid card can allow users to make purchases that require international payment methods.

- Travel & Bookings: Some people use them for booking hotels, flights, or car rentals, especially when traveling abroad.

Advantages of Virtual Prepaid Cards

- Controlled Spending: You can only spend what you load onto the card, reducing the risk of overspending.

- Better Security for Online Transactions: No physical card means lower chances of theft or unauthorized use.

- Easier Access for International Services: Virtual cards are commonly issued by international banks, making them accessible on platforms where local cards might be blocked.

Disadvantages

- Limited Usability: Since they’re digital-only, they can’t be used at in-person stores without a contactless or NFC option.

- Potential Fees: Some virtual prepaid cards come with activation fees, reload fees, or maintenance charges, so it’s important to check the terms before getting one.

- Expiry & Balance Restrictions: They may expire within a few months to a year, and any remaining balance might be forfeited if unused.

Overall, virtual prepaid cards offer a convenient, secure, and flexible way to make online purchases, manage spending, and access international services without needing a traditional bank account or credit card.